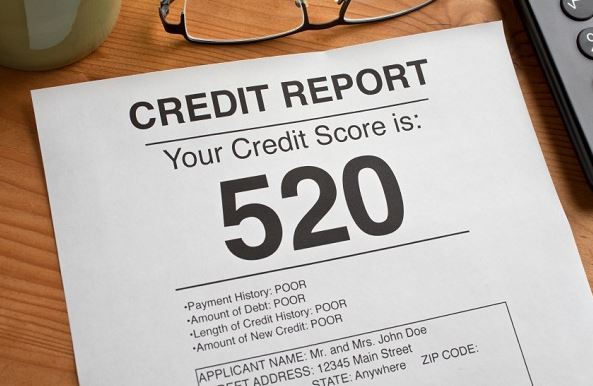

How Bad Credit Can Negatively Impact One’s Finances

Having good credit is essential for financial stability and success. It enables individuals to access favorable interest rates, secure loans, and enjoy various financial opportunities. On the other hand, bad credit can have severe consequences, leading to financial difficulties and limitations. Of course, trusted lenders like bad credit loans California can come in handy when seeking loans, but it’s still important to have a good credit score. Below are details on how bad credit can negatively impact one’s finances and why it’s crucial to maintain a healthy credit score.

Difficulty Securing Loans

One of the most immediate and tangible impacts of bad credit is the difficulty in securing loans. Lenders consider credit scores when evaluating loan applications, and individuals with low credit scores may face rejection or have limited access to credit options. This can be challenging when trying to finance major purchases, such as a home or a car, or when seeking personal loans for emergencies or other needs.

Higher Interest Rates

Even if individuals with bad credit manage to secure a loan, they often face higher interest rates. Lenders view borrowers with lower credit ratings as higher-risk borrowers, leading them to compensate for the perceived risk by charging higher interest rates. Over time, these higher interest rates can significantly increase the cost of borrowing, making it harder to pay off debts and potentially trapping individuals in a cycle of debt.

Limited Access to Credit Cards

Credit cards can serve as a convenient financial tool, providing flexibility and the …

to ask security in case you default …

to ask security in case you default …