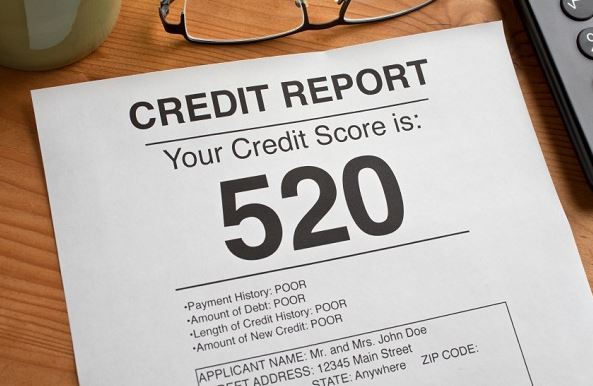

Bad Credit: How You Can Qualify for a Loan with a Poor Credit Score

Loans have turned out to be a savior for many who usually find themselves in difficult financial situations. You might find yourself in a position where you will be required to pay for something or finance something when you have no money at all. Loans can be helpful in such a situation. There are several lenders giving out cash in the form of other normal loans.

You should try them out to see if you can get some cash to salvage your situation. Online lenders have also become common in this day and age, thanks to the availability of smartphones and easy access to the internet. You can now borrow money from the comfort of your home. This is something that has helped bring about some convenience to many, different from the conventional methods where you have to walk from one spot to another to apply and follow up on your loan.

Something you should understand about borrowing is that you will be required to pay the amount with some bit of interest after a certain period. Not complying may see you get blacklisted and you will not be able to access any loan. There are credit bureaus that usually follow up on such. You should not worry because there are specific ways you can get loans even with a poor credit score. Here is how you can qualify for one.

Present a Guarantor

Some lenders will require you to present a guarantor to ask security in case you default the borrowed loan. They will be held responsible if you fail to make timely payments or make none at all. You should look for someone stable to act as your guarantor.

to ask security in case you default the borrowed loan. They will be held responsible if you fail to make timely payments or make none at all. You should look for someone stable to act as your guarantor.

Try Payday Loans

Payday loans are also another option for those who want to get some financial aid with a poor credit score. Most lenders offering it will require your employment information and other personal details which will make you eligible for your loan. With such information, they can get back their money in case you default.

Improve Your Score

You should work on improving your credit score so that you may opt out of your poor credit score. Visit the different credit bureaus to clear your name and pay the amount in dispute. With time, you will improve your score and get other loans. Start making timely payments when you get other loans even on bad credit.